Yet today's policy mindset is dangerously reminiscent of the attitudes that helped to excacerbate the economic downfall of inter-war Germany.

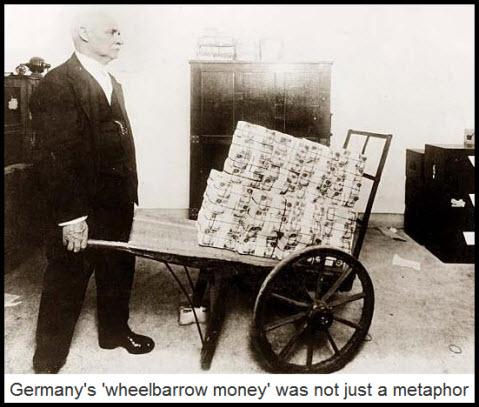

The US Federal Reserve of 2014 is not the Reichsbank of 1914. "The question to be asked - the danger to be recognized - is how inflation, however caused, affects a nation." "It matters little that the causes of the Weimar inflation are in many ways unrepeatable that political conditions are different, or that it is almost inconceivable that financial chaos would ever again be allowed to develop so far," wrote British historian and MP Adam Fergusson in his 1975 classic, When Money Dies. But no episode better illustrates the dire consequences of unsound money or makes a more devastating, real-life case against fiat-currency: where there is no restraint, monetary death will follow. The story of the destruction of the German mark during the hyper-inflation of Weimar Germany from 1919 to its horrific peak in November 1923 is usually dismissed as a bizarre anomaly in the economic history of the twentieth century.

0 kommentar(er)

0 kommentar(er)